Crypto Gaming and NFTs: A Nuanced Perspective

Five years on, where have we come, and where are we going?

Crypto gaming — early on in 2018, we decided to be the green apple in a sea of red, investing against the thesis that crypto would be a foundational layer accelerating mass adoption of open economies in virtual worlds.

Investing into blockchain gaming in 2018 was a profitable strategy. Crypto gaming has been a direct beneficiary of mindshare devoted to the “M” word, with the leading consultancies forecasting a $5-15 trillion metaverse market by 2030. It’s not just that blockchain gaming in 2018 was “correct” (financially at least) – it’s that it was deeply “non-consensus”. Anyone talking about crypto in the gaming industry was immediately written off as belonging to the class of investors not to be taken seriously. In this context, beta was more important than alpha, and it was more important to ride the wave than to pick individual winners.

Now though, the story is different. While crypto gaming still has its deep detractors (and this will be the case for some time), what changed in 2021 was the meteoric rise of Axie Infinity. Crypto gaming had its first breakout hit (financially), and the question for investors shifted from, “Should I invest in this company?” to “Can I afford not to?”

With 100x token opportunities everywhere, and the influx of defi turned crypto gaming investors flooding the market, it became clear that crypto gaming was no longer non-consensus. We are reminded of one large gaming fund in particular whose GPs claimed not to believe in blockchain in 2019, who are now investing nearly all of their fund into crypto gaming at what we believe to be indiscriminate prices.

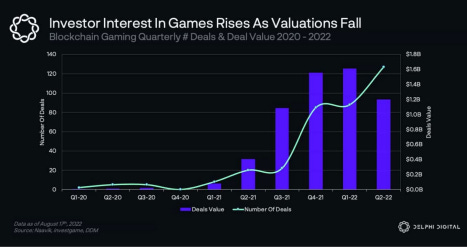

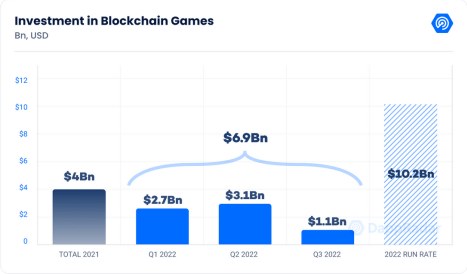

According to Delphi, ~$5b has been invested into blockchain gaming across ~130 deals since 2021. With a more expansive definition of blockchain gaming, DappRadar x BGA pegs this number at ~$11b since 2021. That’s a lot of capital for a space that has yet to make a meaningful impact in the minds of mainstream gamers.

In his 1993 letter to investors, Howard Marks wrote: “The problem is that extraordinary performance comes only from correct non-consensus forecasts, but non-consensus forecasts are hard to make, hard to make correctly and hard to act on.”

While there was much fanfare around the crypto gaming vintages of 2021 and 2022, we did our best to avoid simply following the hype. Amidst the noise, we have been proud to work with many talented entrepreneurs advancing the space, all while flagging key concerns around unsustainable economies, high valuations, team inexperience, and structure/regulation.

- Sustainability. In the last two years, there were a seemingly infinite number of unsustainable Axie clones. At a certain point, we had to take a break from any pitch with the words crypto, blockchain or metaverse in it. Little regard was given to how the game would generate organic, sustainable player demand outside of speculation, or how to design sinks that would enable absorption of token supply.

Integrating speculators/whales into the game experience without disrupting the fun for the broader player base is a difficult design paradigm that the market has yet to crack. We believe there are many lessons to be learned here from web2 open economy games like EVE Online, as well as genres like “SLG” (simulation life game) from Chinese publishers who excel at modern mobile monetization. Those most likely to succeed are those who excel at player conversion and retention in the web2 space and are actively experimenting with web3 primitives while retaining maximum design flexibility (note: token sales represent optionality sold).

- Valuation. In the last two years, token pricing has felt more like an option pricing model than a matter of fundamental investment analysis: the lockup period, liquidity depth and narrative heat of a token opportunity (the “option term and volatility”) was weighed solely against the discount to spot or the expected market cap on listing (the “option price”). During this period, what has mattered more than fundamentals or fully diluted valuation (FDV) was whether one could exit first in the speculative hot potato. As a result of these distortions, we’ve regularly seen pre-product valuations in the hundreds of millions, with some pre-product tokens like Illuvium hitting fully diluted valuations exceeding what Bethesda sold to Microsoft for!

- Experience. The biggest risk to a gaming investment is not whether a particular game is a hit, it’s whether the studio can ship a game at all. Many crypto investors are now realizing they’ve functionally invested in a crypto gaming SPAC (raised capital, need team) rather than an actual game studio. It’s a good time to be an outsourcing studio.

- Structure/Reg. There are foundational questions around what tokens actually entitle investors to. Most crypto games will continue to generate fiat revenues, yet token holders have no contractual claim to these profits. Even if a studio wanted to distribute economic rights to token holders, it likely could not do so without running afoul of securities laws. Yet the wave of crypto investors who only want tokens because they present a path to liquidity (1-3 years) shorter than the venture horizon of equity (7-10 years) has led to significant dislocations in the funding market. Nobody is asking the obvious question: if your virtual currency is only relevant to 1-5% of your game economy, why should it have a valuation of 100-500% of your equity?

Despite these concerns, we have seen promising progress, and investors may consider looking at leading publishers and experienced startup founders in the space. The depth and experience of the teams looking to build crypto games has improved significantly, and valuations have come down to more reasonable levels. Instead of token-only offerings from studios with zero experience at $300m+ fully diluted valuations (Q1/Q2 ‘22), by the start of Q3 2022 only established founders and publisher spin-off studios could raise at these token FDVs. Now in September 2022, we are seeing few “token-only” offerings, as equity + token warrant offerings have become the norm, and at valuations generally not exceeding $100m combined. While valuations for hot projects remain elevated, we think there is significant opportunity from experienced developers that have the ambition and experience to build web3 games that will matter to the mainstream.

What we are looking for is a combination of IP that players care about and an incisive understanding of what drives sustainability in open economies, together with a balanced go-to-market approach that will resonate with the crypto core but has the potential to expand into the mainstream market. Flexibility to invest at all layers of value accrual – whether collectibles (NFTs), tokens or equity – will be key.

We remain sanguine on the potential for virtual currencies to accrue sustained economic value without being deemed securities. This however is a fine line, and much easier if the token is given away as earned engagement and not sold as a fundraising vehicle. Alignment between equity holders and token holders to pursue flexible strategies without the pressure of liquidity is key. We seek Digital Co-Ops:

The big unlock of web3 is the creation of digital co-ops: (i) transparent governance structures, (ii) facilitating a rewarded ecosystem of creators/developers, and (iii) embedding efficient means to exchange value through digital collectibles.

● Transparent governance structures. Having a set of on-chain rules that make it difficult for developers to unilaterally vary the rules of the system. Transparent governance plays an important role in immersion and facilitating open world activity.

● Rewarded ecosystem of creators/developers. Create the potential to return fruits of growth to contributors. The role of the open-world game developer will transform from closed-loop designers into founding contributors of an open ecosystem.

● Exchanging value from digital collectibles. NFTs have the potential to create “status as a service” businesses around game environments and social structures.

In contrast to conventional crypto wisdom, we believe experienced teams from web2 gaming (startup founders and publishers) will harbor competitive advantages over their “crypto-native” counterparts who have never run a game studio. In the blog post above, we spotlighted Nexon’s development efforts around web3 MapleStory as a case study worth following. Strangely enough, being bullish the incumbents who’ve already proven themselves in web2 is turning out to be a “non-consensus” strategy. We believe experience, patience and open-mindedness will be a winning combination in the transition to open economy gaming.

Ultimately, our north star is captured by three keywords: interactivity, community and agency. ‘Meaning’ is a product of the experiences we craft (interactivity), the depth of the relationships we form (community), and the self-sovereignty we have to express ourselves (agency). Crypto has the potential to significantly enhance virtual experiences along these dimensions, but doing so will require a nuanced balancing of the “crowding-out” effect that money tends to have on “fun”.

Is crypto “necessary” to achieve all this? It’s not that crypto is the only way, the first way, or the best way, to bring markets to gaming. Rather, its real power is this: Crypto incentivizes communities to drive creation, curation and commerce in virtual worlds: it is the business model for open-source creativity and engagement. Say what you may about crypto gaming today, this is not a trend we would want to take the short side of.

Deep Dive: The Startup Ecosystem for NFTs

As a prime illustration of the power of open source, we recently encountered this long list of 1,930 crypto projects, a significant proportion of which has raised venture capital. We went down a multi-day rabbit hole of looking through the projects in the GameFi, Music, NFT and DAO verticals, and want to summarize a few overall observations below.

At a high level, we feel crypto investors need a more solid grounding in the “base rate” of startup success. One of our favorite pieces in finance is Michael Mauboussin’s Base Rate Handbook, which provides the foundation for investment decision making grounded in historical base rates of growth and profitability. While it’s still early in web3, one can gain an appreciation for how unlikely it is that your generalized “web3 data/analytics” or “metaverse” startup is to become a billion dollar company by simply looking at the competition.

In this deep dive, we begin with the NFT startup ecosystem. The first thing to say is, there sure are a lot of NFT-related startups!

If you are seeking pain in your life, one possibility is to review all 317 startups in the NFT space from the Long List. Thankfully for the sanity of our readers, we’ve done this for you, and distill some thoughts below. We assume a reasonable level of familiarity with NFTs in this letter. It gets dense quickly, so do skim through this section for particular areas of interest.

For those looking for a primer to NFTs, we would recommend starting with Matt Deslauriers’s piece On Crypto Art and NFTs and Why the Distributed Ledger as great starting points. We would also recommend Galaxy Digital Research’s pieces on NFT Licenses and NFTs & Defi for more intermediate treatment.

Most NFT startups break down into a set of categories roughly corresponding to the below. At 10,000 feet, my observation is that the NFT space is incredibly crowded and has received a bloated amount of funding relative to the TAM. We are very bullish on the GMV that will be unlocked by NFTs/tokens in content ecosystems, but somewhat cautious on the TAM of NFT market infrastructure. Most of these startups are working on minor variants of the same lego blocks.

It’s why from a time and focus standpoint, we would rather spend energy on “web 2.25” (the web2 part being harder than the web3 part) consumer businesses that can demonstrate a credible path towards solving the hard part (getting consumers to care about your content and the status that virtual goods connote in your community) and who are using NFTs and tokens to augment things that consumers already care about, versus pure NFT infrastructure, which sounds smart for VCs looking for “picks and shovels” because “content is a hit driven business”, but has less moats with considerably greater price competition.

Without further ado, here are the major categories of NFT startups as we see them:

Allowlist:

Functionality:

Distribute NFTs to their participants in a provably random manner

Curate whitelists based on real world identity

Membership access to NFT mints prior to public sale

Community gating mechanisms (e.g., Discord for NFT holders)

Observations:

Nearly all of these startups are building “features”, not venture-scale companies.

AMM (Automated Market Maker - refer to NFTs/Defi Report for a primer)

Functionality:

Bring fungibility to NFTs by concentrating long tail liquidity around the floor (the cheapest NFTs in a set, with no particular trait or rarity multipliers)

Allow NFT holders to earn passive income by becoming liquidity providers in NFT automated market making (AMM) pools and earning spread (sometimes passive market making fees, sometimes discretionary alpha)

Race to the bottom on exchange fees and royalties

Observations:

As with defi generally, there is a considerable oversupply of projects looking to bring liquidity to long-tail NFT projects by concentrating markets in the “floors” (lowest offered price) of popular NFT collections. This is usually accomplished through mechanisms similar to futures contracts, where one can settle a futures contract by delivering the “cheapest to deliver” asset meeting the contract specifications.

There is some interesting innovation happening around on-chain orderbooks through Sudoswap — see the Content Roundup at the end of this letter for further details.

While there is some market for this in the PFP trading space (profile picture NFTs, e.g., Bored Ape Yacht Club), I am skeptical that any of these NFT AMM platforms will achieve venture scale, primarily because the underlying collateral does not lend itself to sustainable trading volumes. Note that a considerable amount of NFT trading today is wash trading conducted to earn the native token of the marketplace (often as high as 80-95% of a platform’s volumes).

What will be more important is for web3 game designers to study the innovations of these markets and incorporate them into their own internal marketplaces. For instance, if one were analyzing the cost/benefit of setting up an AMM pool, one would need to weigh the liquidity benefits against the real costs from a Treasury management (to support liquidity mining rewards and exchange listing fees) and player attention standpoint (extrinsic motivators tend to crowd out intrinsic ones).

More gaming projects should be offering periodic price discovery mechanisms (e.g., similar to reverse Dutch auctions conducted by the US Treasury for Treasury securities), as opposed to worrying about providing continuous liquidity through central limit order books.

Analytics

Functionality

Analytics about collectors of your NFT project, bringing together a unified profile across social networks and on-chain activity

Ad targeting and behavioral scoring for users

Alerts, analytics, market data and execution modules for traders

Recommendation engines and discovery platforms

Observations

Another overfunded sector. There are dozens of startups all offering some variant of the same thing.

A couple of analytics tools such as Nansen offer significant utility to pro traders who know how to implement alpha strategies (e.g., watching whale wallets and other indicators of on-chain activity), but the vast majority of pre-canned dashboards are not worth it.

Mint alerts are useful on the margin but the signal of the high frequency, ponzi-like PFP trading game is largely getting drowned out by noise.

As gaming and NFT ecosystems mature, there will be a need for the “Bloomberg of NFT trading”, and that consumer willingness to pay for advanced tools/analytics will be extremely high. I also believe that there won’t be just one winner, but platforms will segment into verticalized specialties — e.g., gaming, art, music, photography, etc.

The combination of quantitative analytics and qualitative curation from trusted community members will be powerful in specialized contexts — e.g., generative art. This is likely to be the first avenue into “web3 social” (which is probably going to be web2 social communities built around web3 collection games).

Appraisal

Functionality

Identification of undervalued NFTs based on trait rarity

Appraisal services for lending platforms

Observations

As a collector, we don’t generally find NFT valuation services useful. There are dozens of startups tackling this space, but until a product with real utility comes out (e.g., perpetuals linked to a robust index), it’s an oversupplied space. No lender will rely on an NFT appraisal service valuation, they will look at traded volumes, liquidity depth, and floor bids and asks.

NFTs have a wide bid-offer, and the value of one’s collection is entirely a function of which side of the market one is on. This makes mid-market valuation services less useful.

Some protocols implement contorted token economic incentives to encourage market bids around NFTs, but I doubt these concepts will ever achieve scale outside of specialized contexts that have achieved player scale— e.g., Harberger land value taxes

Buy Now, Pay Later

Functionality

Allows buyers to purchase NFTs in installment payments, with the first payment generally set at 25% of the NFT purchase price.

Observations

Effectively, this is secured lending collateralized by the value of the payments. The risk is greatest at the outset of the loan, where if the value of the NFT drops by more than 25%, the lender is exposed to uncollateralized market risk of a borrower default on future payments. We don’t believe many lenders will be willing to take this risk for most NFT assets, and think this will remain a small market until LTV ratios fall below 50%.

This could be an interesting method for game developers to extend credit to potential NFT buyers. As the game developer is the “Treasury”, it could conceivably return any defaulted game assets back into the Treasury without incurring a loss, and pocket the upfront premium as compensation.

Creation Studio

Functionality:

Full service agencies to help brands create NFT

Community as a service platforms

Digital architects

Observations:

Leading third party creation studios are likely to be profitable but have somewhat limited upside given their role as agency businesses. In general far too many agency businesses have been funded relative to the market opportunity—many brands are going to in-house their digital collectible production efforts and not rely on third parties. Others are going to work with multiple third party studios in a non-exclusive manner. The market structure makes it difficult to make venture bets in this space.

We believe certain studios who start in third party agency business will be well-placed to create successful first party NFT communities. We are seeing some evidence of this in, for example, digital fashion creation studios working with luxury brands to create high-value NFTs paired with physical couture (e.g., D&G x UNXD NFT sales worth $30m).

Derivatives

Functionality:

Synthetic trading in NFT collections (with or without leverage)

NFT options

Credit default swaps on NFT loan bundles

Semi-fungible tokens wrapping token entitlements, to facilitate active trading in unvested tokens

Observations:

Dave White authored a wonderful paper on perpetuals trading in NFTs. Many projects are trying to build some variant of this theme, and the biggest issue with all of them will be whether there is sufficient liquidity in the underlying to create a continuous market that market makers are willing to provide liquidity into. What users are really looking for is leverage, and the gappiness in NFT trading creates credit risk for exchanges offering these services.

Options markets are likely very far away, despite the number of startups trying to build NFT options markets. I struggle to see how a liquid two-way market (similar to what Deribit has developed for crypto majors) is going to develop for NFTs, given differing liquidity dynamics on the underlying.

The idea of credit default swaps on NFT loan bundles is interesting in theory but practically unworkable because of the risk of collusion between loan borrowers and buyers of protection on loan bundles.

There is room for greater automation in distributing vesting tokens to investors, where unvested token entitlements convert over time into vested token balances. If unvested token entitlements get instantiated on chain as “semi-fungible token” instruments (fungible with other tokens vesting on the same date), it becomes possible for an active market to develop in these token entitlements.

Fractionalization

Functionality:

Fractional ownership of NFTs, on an SPV basis

Social ownership of art and digital collectibles

Observations:

We are not believers in one-time SPV structures that offer a group of strangers the ability to own a fractional share of a high value NFT, for the simple reason that the collector does not accrue the same level of enjoyment as he/she would when collecting the NFT. While this works well for commodities and collectibles where the collecting motivation is primarily financial (e.g., securitized bluechip art), we do not believe NFTs are mature enough to support this manner of collecting.

However, we are big believers in the power of small group social ownership in the context of repeat interactions and known community. For example, some of our partners are in a group of <100 collectors banding together on the Tezos blockchain to collect blue chip art, and we find the discovery and curation process to be as gratifying as it would be if we were collecting individually. Moreover, because digital art is a non-rivalrous good, any one of our group could justifiably display such art as their own without feeling like a fraud (unlike for example a Picasso owned by a group of people, where physical possession is paramount).

The killer use case for social ownership to date has been NFT art, but going forward gaming guilds will dominate the social ownership use case for NFTs, especially as tools develop for the integration of co-owned virtual goods into the player experience.

We don’t think the future will be dominated by the “mega-guilds” you see in crypto gaming today, but micro guilds satisfying the “two pizza rule” who develop expertise in particular titles and genres (small group alpha).

Infrastructure

Functionality:

APIs for indexing NFT metadata and transactions

Backup solutions for NFT media files

NFT wallets and credit card processing

NFT creation SDKs for game developers

KYC/AML for NFT issuers

Blockchain scalability

Observations:

One of the things you grow to appreciate after being in the NFT space long enough is, for a space that prides itself on decentralization, how centralized the market structure actually is.

Moxie Marlinspike created quite the stir in the NFT community in calling out some of these realities in his blog “my first impressions of web3” earlier in the year.

These realities create opportunities for infrastructure providers bridging the on and off-chain worlds—e.g., providers of integrated payments, wallet and SDK solutions to game developers.

One big misconception of NFTs is that the media is stored on-chain. With the exception of certain on-chain NFTs (10% of NFTs), the metadata associated with an NFT generally points to a centralized server (40% of NFTs) or IPFS (50% of NFTs)—and therefore the media associated with these NFTs are subject to risk of loss. Jason Bailey wrote about these issues here. This speaks to the importance of backing up one’s NFT collection.

There are potentially unexpected consequences to issuing tokens/NFTs that organizations need to be mindful of. The complexity of these issues creates opportunities for providers of advisory, compliance and licensing services. For example:

Is a token is a “security” under local law?

Does a particular NFT drop violate gambling or lootbox regulations?

Is a game’s marketplace consistent with App Store or platform regulations?

Can tokens/NFTs be bought/sold by a Treasury without running into market manipulation concerns?

How are IP issues associated with NFTs (particularly user generated content) handled?

Do issuers of “virtual currency” need to conduct KYC and transaction monitoring over flows in their economies, and integrate compliance monitoring solutions?

Marketplaces/Aggregators

Functionality:

Opensea for [Chain X]

Aggregators for best execution across multiple marketplaces

Zero royalty trading marketplaces

Verticalized marketplaces for particular interest groups (e.g., photography, generative art)

SDKs for marketplace functionality within games

Observations:

Marketplaces have been the most profitable segment in the NFT sector, with everyone looking to create the “next OpenSea”.

There have been many attempts from NFT marketplaces to take market share away from Opensea. This has been driven by some combination of volume-based token incentives, lower fees and zero royalty features. (Note: royalties are enforced at the marketplace level as a matter of social convention, not at the smart contract level.)

Other marketplaces compete on the basis of unique execution protocols, which emphasize floor-based liquidity concentration mechanisms. While these marketplaces have been mildly successful at taking market share away from Opensea, volumes have generally failed to sustain (e.g., LooksRare/X2Y2).

Key to implementing successful marketplaces will be bringing new sources of organic liquidity outside of financial speculators—e.g., in a virtual world, creating prompts within the game to encourage players to buy/sell virtual goods within the right social contexts.

Professional market makers are not likely to get involved in providing “long tail liquidity”. Relying on new sources of retail market making supply in the form of game players will be critical. Concentrating liquidity in “fungible” variants of NFTs can only get you so far.

Token models for marketplaces are compelling in theory (rebate a specified percentage of marketplace fees back to tokenholders, or implement buyback/burn mechanisms) but have the potential to raise securities law and market manipulation concerns.

Verticalized marketplaces that are tightly integrated with the social context of the underlying game or collection activity are likely to take share from generalized marketplaces like Opensea over time.

Lending

Functionality:

Secured lending, where borrowers can take loans against escrowed NFTs ranging from 25-75% of floor ask LTV at APRs typically ranging from 15-75%.

Pricing can either be algorithmic or on a RFQ (request for quote) basis.

Increasingly, pricing is automated for top-tier collections, coalescing on 50% LTV / 20% APR for high quality collections/borrowers. This allows borrowers to obtain liquidity against blue chip collections instantly.

Observations:

Continued growth in lending volumes over the last 12 months is testament to “trustless lending” being a real use case(try getting a 75% LTV / 20% APR 90 day loan against your physical art!). Ultimately, the TAM today is limited by a small number of borrowers and blue-chip NFT collections worth lending against. Where does this market go from here?

Despite healthy competition, just like with the crypto exchange market, the large platforms will continue to amass market share, as lending pools concentrate their integration efforts on the leading platforms (e.g., NFTfi) and as composable frameworks get created around the promissory notes themselves.

It will be interesting to observe whether lending platforms end up whitelabeling their architecture to games for a more integrated player-driven borrowing/lending experience. Without a more seamless integration, it is tough to imagine deep lending pools developing around the long tail of NFT assets—e.g., swords in XYZ game. This liquidity is most likely to come from in-game marketplaces that integrate with the escrow architecture of lending platforms on the back end.

The next evolution for NFT markets will be in the context of reintroducing trust to unlock new financial primitives. Vitalik’s post on soulbound tokens, together with this paper from Microsoft Research, Flashbots and the Ethereum foundation, were quite thought provoking for me in thinking through what might be possible when combining identity/trust with open market primitives. The next “zero to one” protocol-layer innovations in NFTs will likely relate to this field. For now, the space is well covered, and we are focused on the application of these primitives to content ecosystems.

Further Reading

Richard writes regularly on topics at the intersection of web3 x consumer at Meandering Musings. Other suggested content from the past few months follows below.

Reports

Articles

Blogs

Tweets

Regular Updates

As the CEO of a web3 game studio, I can't thank you enough for this post. We've been making design decisions serendipitously aligned with many of the principles you've outlined here, so it's fantastic having outside and independent validation of the direction we're taking our game.

We came to a similar conclusion that web3 game sustainability is more f2p+; therefore, established f2p publishers and teams can have a substantial edge over pure crypto native teams. Making a fun game is part art and lots of science.

Excellent primer on the current state of web3. I subscribed!